Accounting used to feel like an endless cycle of exporting spreadsheets, reconciling numbers, and hoping nothing slipped through the cracks. Today, you can swap that grind for instant visibility and data-driven confidence. Intuit Enterprise Suite (IES) turns month-end chores into a strategic advantage by streaming live insights from every corner of your organization. As we shared in a Fourlane-hosted QuickBooks & ERP webinar, “What used to take days in Excel now takes seconds,” because consolidated financials update the moment a transaction posts.

If you read Part 1, you’ll remember we built the plumbing: linking legal entities, mapping intercompany accounts, and automating data entry so transactions move seamlessly across your enterprise. In this installment, we turn on the water and show how that foundation powers real-time financial intelligence—consolidated reporting, multi-dimensional analysis, interactive dashboards, AI-driven anomaly detection, cash flow, and dynamic budgets. By the end, you’ll see IES not just as accounting software, but as the engine of smarter decision-making for growing mid-market businesses and beyond.

From Setup to Strategy

All the value of IES begins once the system is live. With clean, structured data flowing between entities, finance teams can move beyond closing the books to understanding performance, spotting trends, and making faster decisions. IES becomes more than an accounting platform; it becomes your financial intelligence system.

Transforming Consolidated Reporting with IES

Legacy consolidation often feels like copy-paste gymnastics. The difference between old and new comes into sharp focus:

- Data gathering: Export separate P&Ls and balance sheets for each company

vs. open a single, multi-entity report that updates automatically. - Account alignment: Manually realign charts of accounts

vs. standardized accounts shared across all entities. - Intercompany eliminations: Hunt down due-to/due-from balances

vs. automatic offsetting the moment a transaction posts. - Timing: Work with yesterday’s numbers

vs. review live results during the current period. - Risk exposure: High chance of formula errors and version sprawl

vs. a single source of truth everyone can trust.

Once your entities are mapped, consolidated financials update in real time. You can open a P&L, balance sheet, or cash flow and drill by entity, department, or project—no exports required. What used to take days now takes seconds, freeing your team to analyze results and advise the business instead of cleaning up spreadsheets.

“Our consolidation time dropped from three days to three hours – and we actually trust the numbers.”

— Fourlane IES Client

| QuickBooks Desktop- The Old Way | Intuit Enterprise Suite- The New Way |

| Separate company files | Real-time consolidation |

| Manual Excel merges | Auto-elimination of intercompany entries |

| Risk of errors and missing eliminations | Drill-down by entity, project or dimension |

| Delayed close cycle | Fast, clear financial closes |

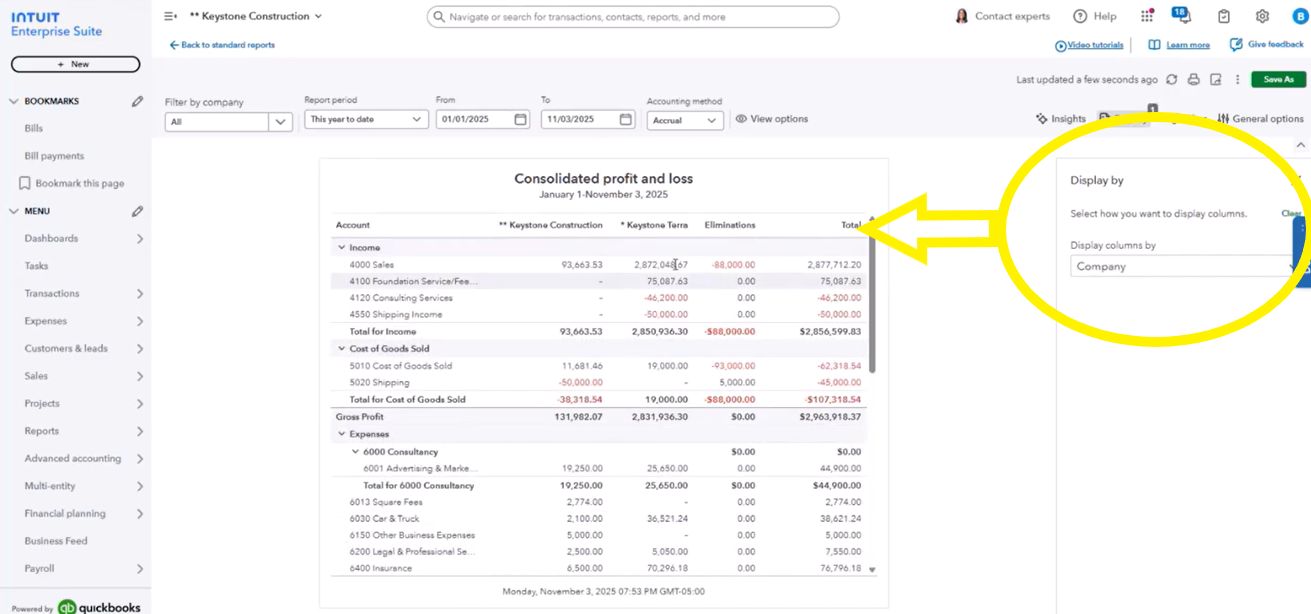

In-product experience: View side-by-side columns for each company, an elimination column, and an enterprise total. If your team prefers Excel, Spreadsheet Sync keeps your models live with real-time data.

Automating Multi-Entity Consolidation

IES treats multi-entity accounting as a living system, not a bolt-on:

- Zero duplicate entry: Post once; IES creates the reciprocal side automatically.

- Instant eliminations: Due-to/due-from balances clear in real time, keeping consolidation audit-ready.

- Entity-level transparency: Drill from blended totals down to a single subsidiary—or even line item.

- Scale without chaos: Add entities, currencies, or departments without rewriting spreadsheets.

- Shorter closes: Close durations shrink from days to hours; time shifts to KPI scorecards and planning.

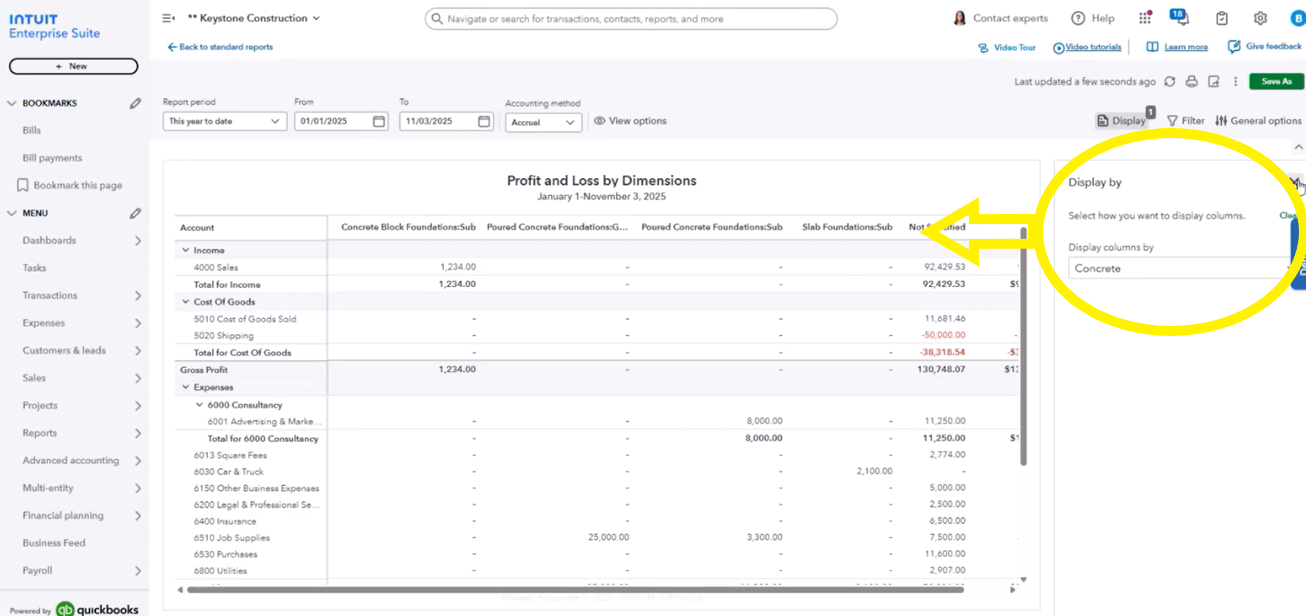

Dimensions: Deep Analysis Without Chart-of-Accounts Sprawl

Classes and locations only go so far. Dimensions in IES act like intelligent tags at the line level, letting you slice results far beyond those limits, e.g., department, product line, funding source, region, customer group, project manager, and more.

What this unlocks:

- Granular profitability: Track margin by product line, region, or customer group – even across entities.

- Marketing clarity: Compare campaign effectiveness across locations and channels.

- Operational insight: Surface patterns in labor, materials, or overhead by any combination of department, project, or entity.

- Simpler CoA: Fewer redundant GL codes; cleaner books as you scale.

- Real-time decisions: Filter a consolidated P&L by any dimension and drill with one click.

Because dimensions are captured on each transaction line, every data point becomes quarriable across all entities – and those identifiers flow instantly into reports, dashboards, and forecasts.

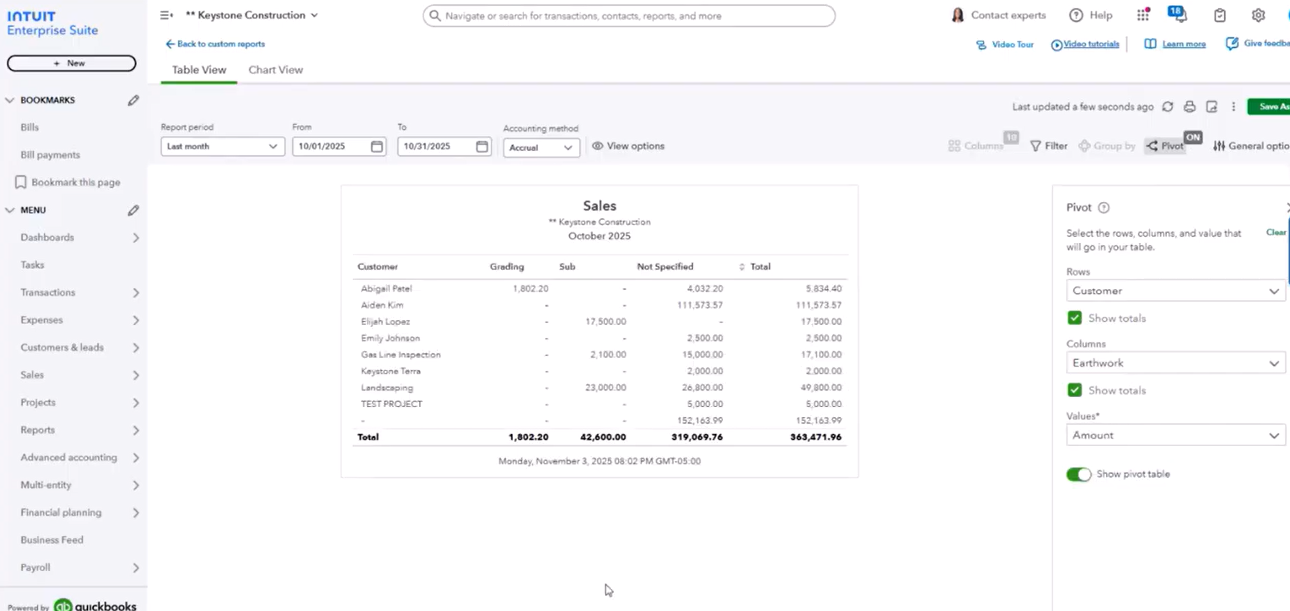

Custom Reports & Interactive Dashboards (for Everyone)

IES puts a drag-and-drop report builder in everyday users’ hands. Reorder columns, add filters, pivot by customer or department, and save templates for repeat use. Moments after a transaction posts, its impact appears in your P&L, multi-dimensional reports, and KPI scorecards—no export-import shuffle.

Role-based dashboards extend that self-service ethos:

- Executives monitor revenue, gross margin, and cash across entities.

- Controllers track AR/AP, close status, and variances.

- Department leaders follow project profitability, billable hours, and budget burn.

Permissions ensure each user sees what matters to them—and nothing else—while live numbers eliminate version confusion.

Maximizing Collaboration with Spreadsheet Sync

Prefer Excel or Google Sheets? Spreadsheet Sync connects those models directly to IES, so formulas update the instant underlying transactions change.

Benefits include:

- Unified data fabric: One version of the truth – no broken links or risky copy-pastes.

- Faster scenarios: Tweak assumptions and watch dashboards refresh in real time.

- Streamlined audits: Trace a number from a sheet back to the source entry in a click.

- Cross-functional alignment: PMs, accounting, and executives collaborate on the same live figures.

- Effortless scale: Add a subsidiary and see it appear in your consolidated workbook automatically.

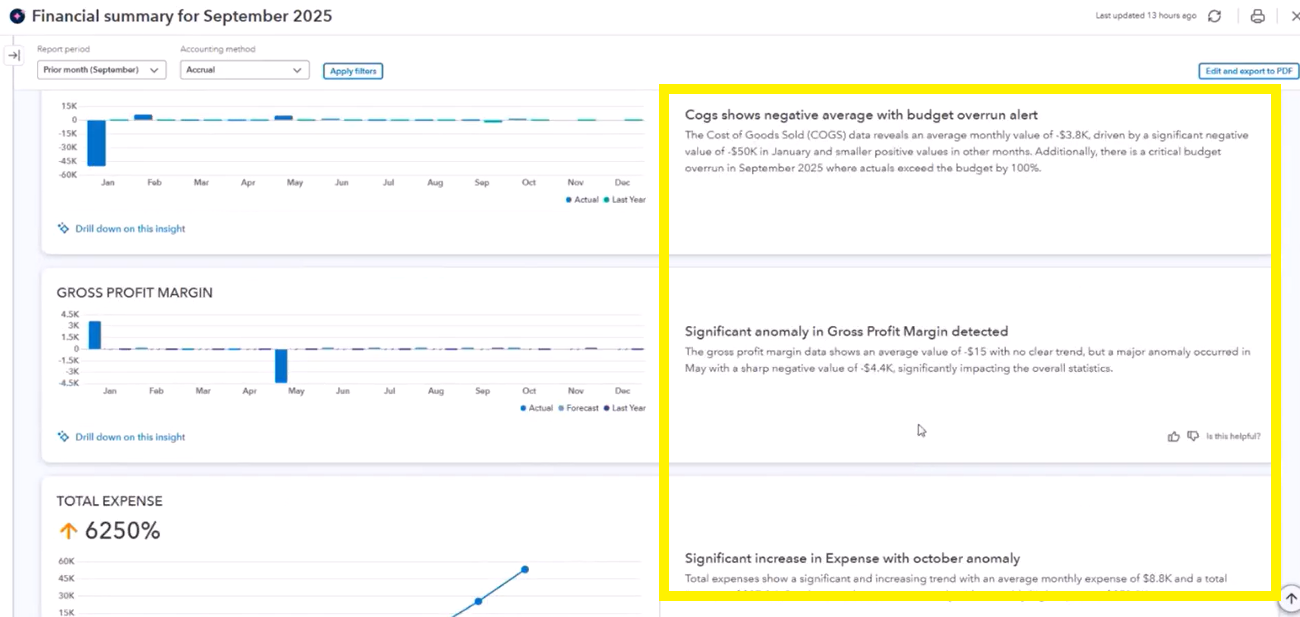

AI Oversight & Anomaly Detection

Manual variance analysis used to mean scrolling through rows after close. IES replaces that with an always-on intelligence layer that reviews every transaction as it hits your books.

- Proactive alerts: Flags spikes in spend or unusual dips in revenue before they snowball.

- Context included: Surfaces likely drivers—vendor, department, dimension—so you can act immediately.

- Self-training logic: Learns from your corrections to reduce noise and catch miscodings faster.

- Audit trails: Captures who changed what, when, and why for clean governance.

Result: Fewer surprises, faster closes, and higher data confidence.

Managing Cash Flow & Budgets in Real Time

Cash is the lifeblood of any multi-entity operation. IES streams live data from every entity into a single cash-flow view (with 13-week outlooks), pulling receivables, payables, and intercompany activity the moment they post. On the budgeting side, build dynamic budgets from trusted actuals, subdivide by entity/department/project, and compare budget vs. actual daily—not just at month-end.

Best practice tips:

- Roll forward live templates from prior actuals, then tweak by % or absolute.

- Subdivide budgets for entities or funding sources while maintaining a consolidated view.

- Pair budgets with AI alerts so variance thresholds trigger notifications.

- Integrate cash-flow forecasts with scenarios (new markets, FX shifts) without ever exporting data.

Best Practices for Clean, Efficient IES Reporting

- Standardize your chart of accounts across entities for instant alignment.

- Review intercompany mappings monthly, especially after adding entities or accounts.

- Document dimension naming conventions to prevent duplicates and keep filtering intuitive.

- Use role-based permissions to protect sensitive data and reduce posting errors.

- Favor dashboards over static exports to cut errors and speed decisions.

- Schedule monthly variance reviews powered by AI anomalies.

- Archive/version your report templates to drive consistency and accelerate onboarding.

The Takeaway: A Financial Command Center

IES condenses once-disjointed tasks into a single, intelligent workflow: automated consolidations, multi-dimensional analysis, role-based dashboards, AI-driven oversight, and real-time cash-flow forecasting—all from the same trusted data. The payoff is bigger than tidy spreadsheets and faster closes; it’s the freedom for leaders to focus on strategy, growth, and change management with confidence in their numbers.

“One takeaway from our blog: IES transforms financial management from a set of disconnected tasks into a continuous, intelligent process—one that saves time, enhances accuracy, and empowers better decisions at every level.”

Ready to experience the difference?

Contact the Fourlane team for a personalized IES demo and see how real-time financial intelligence can become your lasting competitive advantage.