Introduction

Global business operations often require managing transactions in multiple currencies. QuickBooks Desktop provides functionality to accommodate this need; however, enabling the feature requires careful planning and an understanding of its limitations. This article provides a structured overview of how to activate and manage multiple currencies in QuickBooks Desktop, as well as best practices for maintaining accurate financial records.

How to Enable Multiple Currencies in QuickBooks Desktop

Activating multiple currencies in QuickBooks Desktop is a permanent change and cannot be reversed. Before enabling the feature, create a backup copy of your company file.

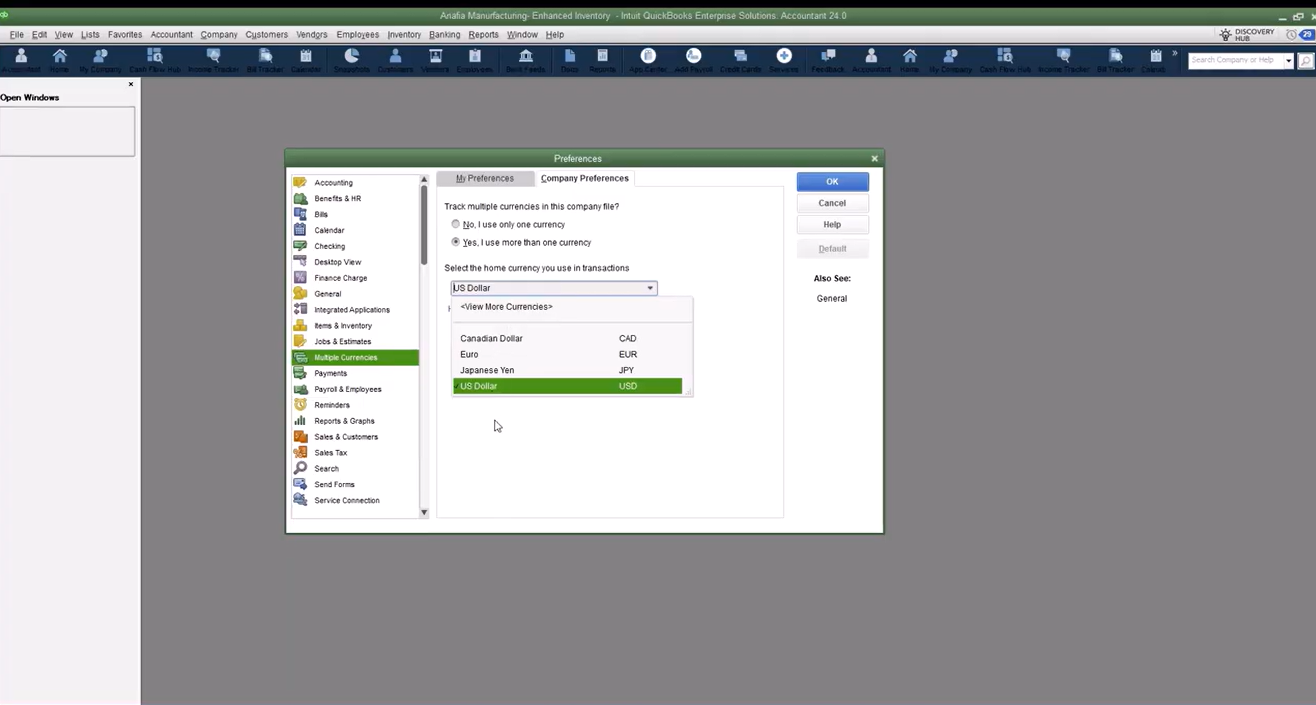

Steps to enable:

- Navigate to Edit → Preferences → Multiple Currencies.

- Select your home currency (e.g., US Dollar). All financial reports will be generated in this currency.

Limitations to consider:

- Features such as the Cash Flow Hub, Insights tab, Bill Tracker, and Batch Invoicing will be disabled.

- Online Payments and QuickBooks Mac file sharing are not supported.

- Prepayments from sales orders and mileage tracking features are unavailable once enabled.

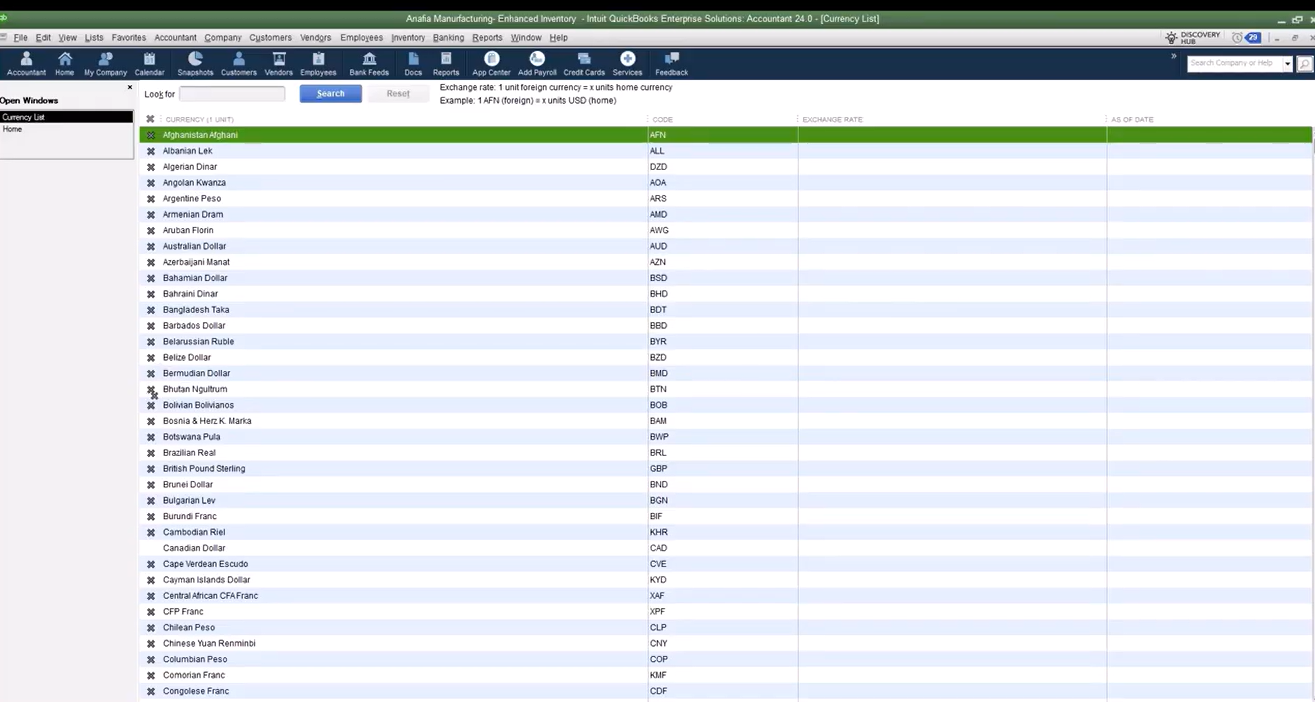

Setting Up and Managing Currency Lists

QuickBooks Desktop includes a wide range of global currencies. To use one:

- Activate it in the Currency List.

- Download exchange rates manually via the Activities tab. Rates are sourced from S&P Global (formerly IHS Markit).

- Update exchange rates daily for accurate reporting.

Users may also manually enter custom exchange rates and adjust formatting preferences such as decimal placement and grouping symbols.

Managing Customers, Vendors, and Accounts

When working with multiple currencies, setup and organization are critical:

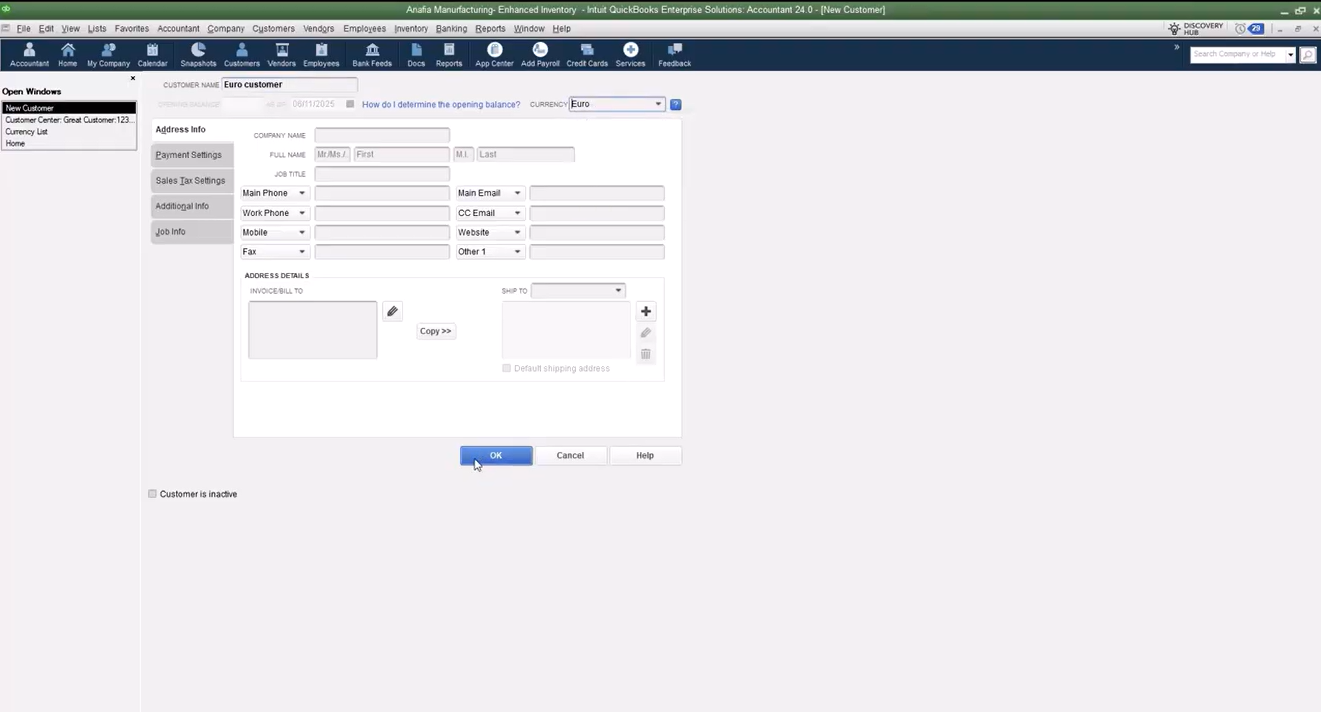

Customers and Vendors

- New customers and vendors must be assigned a currency during setup. (NOTE: Once the first transaction for customer or vendor is created, you cannot change the currency.)

- Existing records with transactions remain locked to the home currency.

- If an entity operates in multiple currencies, create separate profiles for each currency.

Chart of Accounts

- QuickBooks creates Accounts Receivable and Accounts Payable accounts for each activated currency.

- A gain/loss account is automatically generated once transactions occur.

- Foreign bank accounts may also be created in their respective currencies.

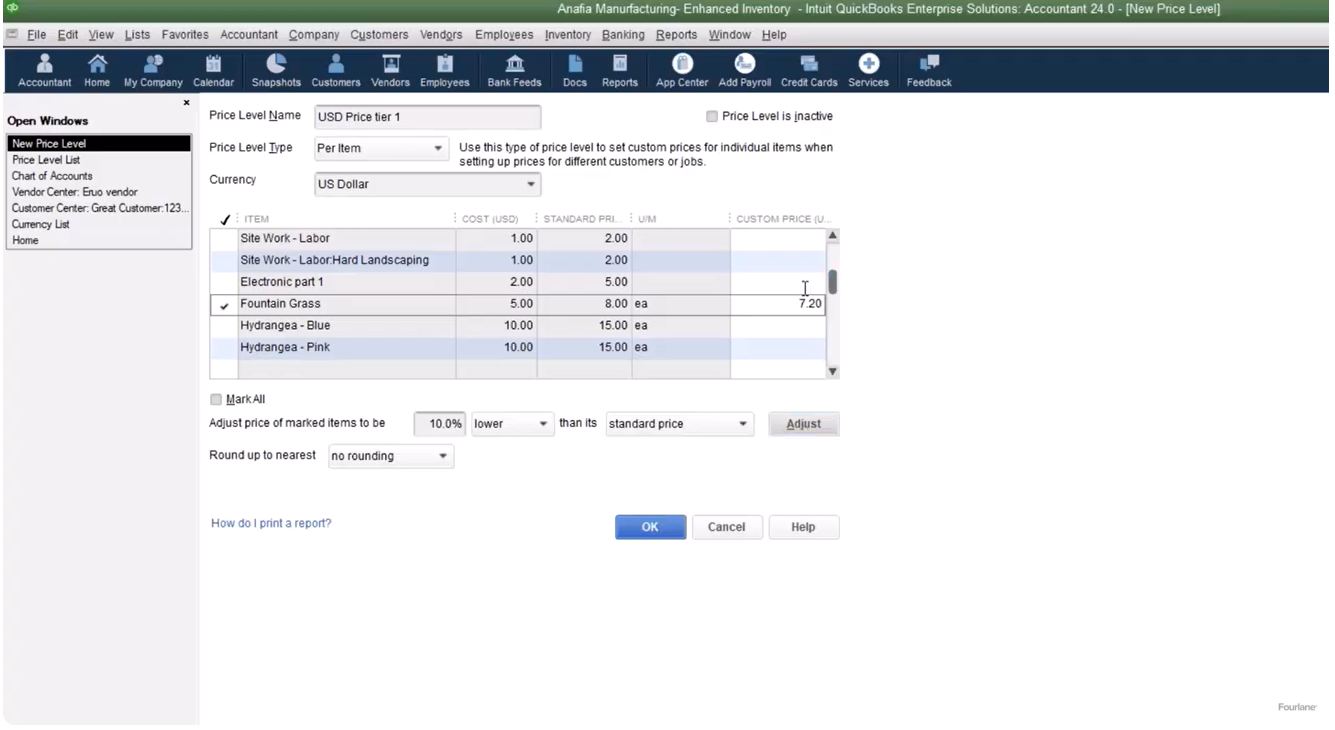

Price Levels

- Pricing tiers must be created separately for each currency.

- For example, a 10% discount in USD must be replicated in EUR for Euro-based customers.

Recording Transactions with Multiple Currencies

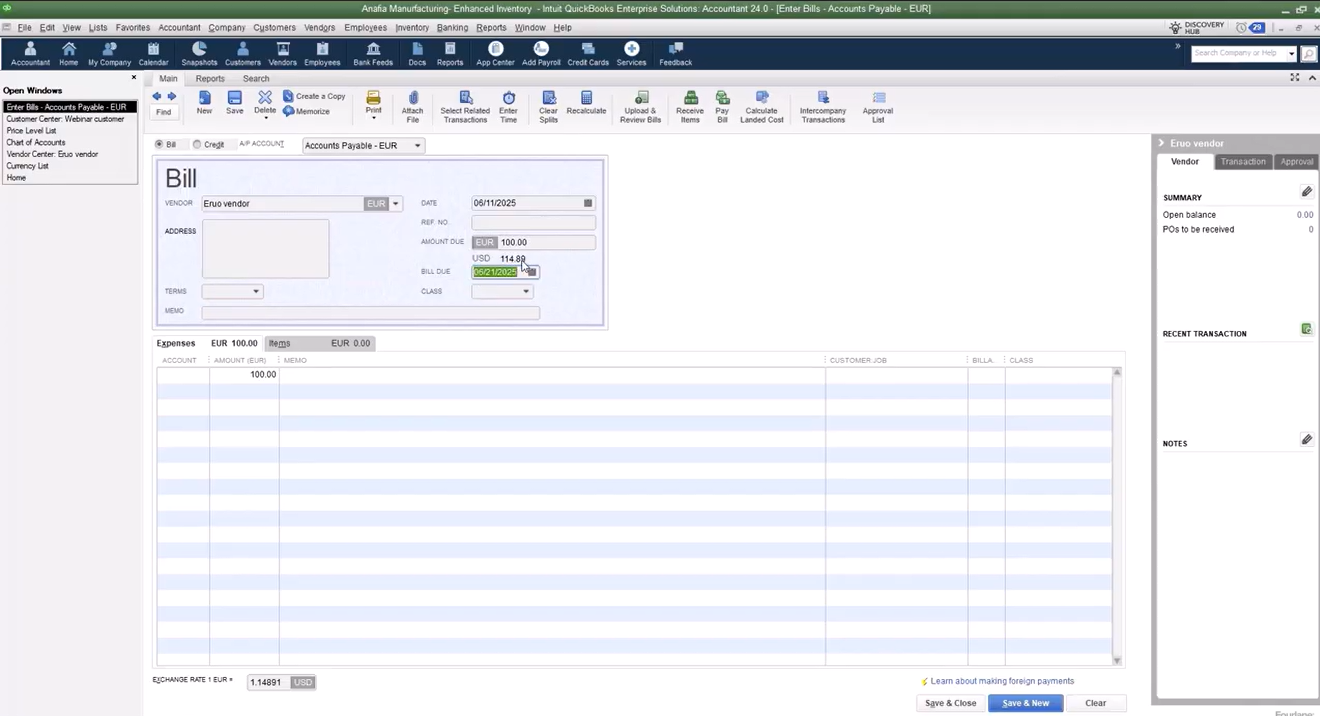

QuickBooks automatically converts foreign currency amounts into the home currency using the exchange rate for the transaction date.

If the exchange rate changes between transaction and payment, QuickBooks records the difference as a realized gain or loss.

Example:

- A €100 bill may convert to $114.50 USD at the time of entry.

- If paid later at a different rate, QuickBooks adjusts the USD value and records the difference.

This process applies equally to accounts payable and accounts receivable transactions.

Reporting Options in QuickBooks Desktop

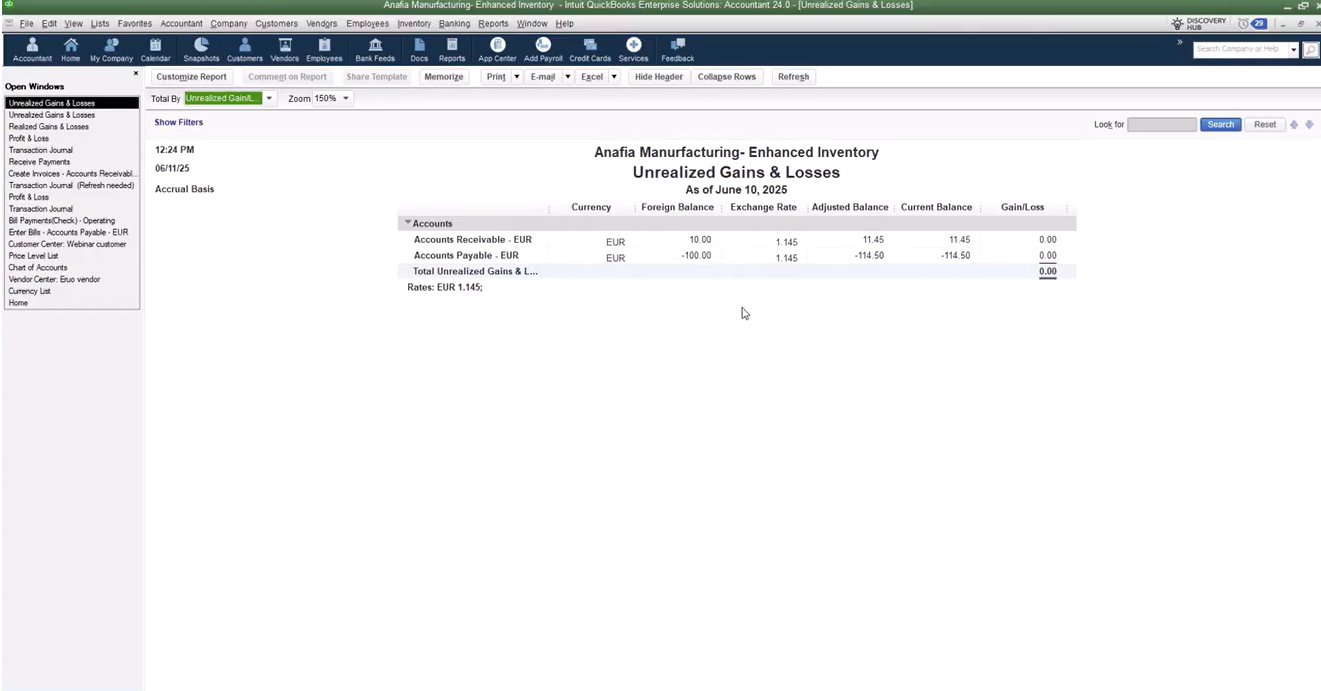

QuickBooks provides several specialized reports for monitoring exchange rate impacts:

- Realized Gain/Loss Report – Identifies gains or losses from currency fluctuations on completed transactions.

- Unrealized Gain/Loss Report – Projects potential variances on unpaid balances at current exchange rates.

- Aging Reports (A/R and A/P) – Show balances in the home currency, though filters can isolate specific currency accounts.

All reports are consolidated in the home currency for consistency in financial reporting.

Best Practices for Using Multiple Currencies

- Plan carefully – Once enabled, the feature cannot be disabled.

- Update exchange rates daily – Accurate reporting depends on current rates.

- Separate records where needed – Customers and vendors working in multiple currencies require duplicate profiles.

- Review gain/loss reports regularly – Monitor the financial impact of currency fluctuations.

Frequently Asked Questions About Multiple Currencies in QuickBooks Desktop

Can I disable multiple currencies in QuickBooks Desktop once it’s enabled?

No. Once multiple currencies are enabled in QuickBooks Desktop, the feature cannot be turned off. This is why it is critical to create a backup of your company file before activation and carefully review the limitations.

Does QuickBooks Desktop automatically update exchange rates?

No. QuickBooks Desktop does not automatically update exchange rates. Users must manually download or enter updated exchange rates daily to ensure financial accuracy. Exchange rates are sourced from S&P Global (formerly IHS Markit).

How are reports displayed when using multiple currencies?

All financial reports in QuickBooks Desktop are generated in the home currency you selected during setup (e.g., USD). While you can filter by foreign currency accounts, balances and totals in reports are always shown in the home currency for consistency.

Can customers and vendors use more than one currency in QuickBooks Desktop?

Not within a single profile. If a customer or vendor transacts in multiple currencies, you must create separate records for each currency. For example, one profile in USD and another in EUR.

What types of reports help track currency fluctuations in QuickBooks Desktop?

QuickBooks provides specialized reports, including:

- Realized Gain/Loss Report for currency differences on completed transactions.

- Unrealized Gain/Loss Report for projected differences on unpaid balances.

- A/R and A/P Aging Reports, which consolidate outstanding balances in the home currency.

Which QuickBooks Desktop features are unavailable with multiple currencies?

Several features are disabled, including:

- Cash Flow Hub

- Insights Tab

- Bill Tracker and Batch Invoicing

- Online Payments integration

- QuickBooks Mac file compatibility

- Prepayments on sales orders

- Advanced mileage tracking

Is the multiple currencies feature available in QuickBooks Online?

Yes, QuickBooks Online also supports multiple currencies. However, the functionality and limitations differ from QuickBooks Desktop. Businesses should review both products carefully to determine which solution best fits their needs.

Conclusion

The multiple currencies feature in QuickBooks Desktop is a valuable tool for organizations engaged in international transactions. By understanding its limitations, keeping exchange rates current, and monitoring financial reports, businesses can manage cross-border activity with confidence and precision.

At Fourlane, our consultants specialize in optimizing QuickBooks for businesses of all sizes. If you are considering enabling multiple currencies or require expert guidance, our team is available to assist with setup, training, and best practices.